THE BEST IN CLASS

Schließen

“THE NOTION THAT YOU COULD BRAND A PRODUCT THAT NO ONE HAD EVER SEEN AND THAT NO ONE UNDERSTOOD WHAT IT DID WAS BRILLIANT”bill gates

LYRICS THE THESIS RETROCESSION OF EMIGRATION

The best in class - Digital system aplications .

Chapter 13

Lena Start up The Lean Startup provides a scientific approach to creating and managing startups and get a desired product to customers' hands faster. The Lean Startup method teaches you how to drive a startup-how to steer, when to turn, and when to persevere-and grow a business with maximum acceleration. It is a principled approach to new product development.

LES^SENCE..... In the movement known as Lean start-up, a new enterprise starts with an idea about what customers want, not an idea for a product. Quick iterations that incorporate. .....FORCE.

Best-in-class: a strategy ahead of its time

‘Best-in-class’ was the second of the 21 different SRI strategies to be developed (after negative/ethical screening) and took strongest root in Continental Europe – where it was supported by the development of numerous rating and ranking models.

Its strengths lie in its:

In spite of these strengths, ‘Best-in-Class’ receives much less airtime than other SRI strategies and is in danger of being eclipsed altogether. Indeed the rapid evolution of other SRI strategies (engagement in Australia & the UK, single-issue screening in the USA, normative screening in Scandinavia, sustainable thematic investment in every country) has led some to argue that ‘Best-in-Class’ is yesterday’s strategy.

These people are wrong! ‘Best-in-class’ remains tomorrow’s strategy even though it was developed yesterday.

To understand this paradox, we must consider how the criteria for ‘Best-in-Class’ analysis are developed and the relationship between ‘best-in-class’ and the widely-acknowledged strategy for tomorrow ‘integrated analysis’.

To assist in this, we divide the best-in-class strategy into two:

Both forms of ‘best-in-class’ aims for the same outcome: better investment performance. However, there is a considerable difference in the precision with which this is sought.

Eco-weighted best-in-class

‘Eco-weighted best-in-class’ is a simple constraints system whereby environmental, social and economic criteria are used to create a subset of better performers from any given industrial sector. The criteria are selected and weighted based purely on their ability to measure a company’s impact on the environment, society and the economy.

The outperformance thesis for ‘eco-weighted best-in-class’ rests on a general assumption that more responsible companies perform better and that a set of criteria developed from a pure sustainability perspective should lead to investment outperformance. This thesis can only really be tested by general retrospective back testing of a whole ‘best-in-class’ universe against its broader parent universe

Investment-weighted best-in-class

‘Investment-weighted best-in-class’ is also a classification system based on environmental, social and economic performance. However, in this case, the criteria are developed with a close focus on the expected investment effects of the criteria. Indeed each criterion is developed through a process of integrated analysis whereby environmental, social and economic factors are selected for use based on their expected contribution to investment outperformance. Every sustainability indicator and sub-indicator is underpinned an explicit investment rationale.

On top of this, managers of ‘Investment-Weighted Best-in-Class’ strategies may use attribution analysis techniques to review the investment effects of their selection criteria.

The investment outperformance thesis for ‘investment-weighted best-in-class’ rests on explicit and visible links between individual sustainability factors and investment drivers. Each link can be isolated in turn and tested on a step-by-step basis.

In this final respect ‘investment-weighted best-in-class’ can be considered as a systemic consolidation of ‘integrated analysis’ investment ideas. ‘Integrated analysis’ is today’s SRI challenge; so ‘investment-weighted best-in-class must be tomorrow’s. QED.

012345

| 2004 | |

| • 1.52 | |

21 SRI strategies

As the ‘Sustainable and Responsible Investment’ industry has grown and evolved, its sophistication has increased greatly such that twenty-one distinct SRI strategies can now be identified:

In addition to these, other terms that are used commonly – but do not classify as unique strategies - are:

Lena Start up

The Lean Startup provides a scientific approach to creating and managing startups and get a desired product to customers' hands faster. The Lean Startup method teaches you how to drive a startup-how to steer, when to turn, and when to persevere-and grow a business with maximum acceleration. It is a principled approach to new product development.

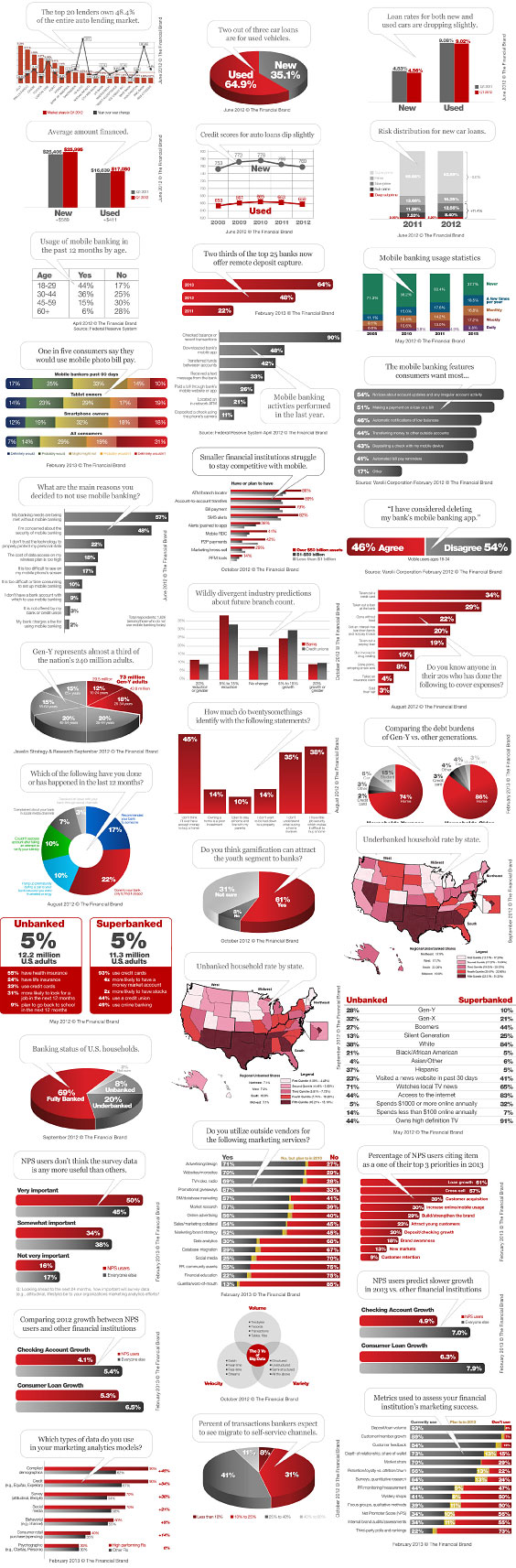

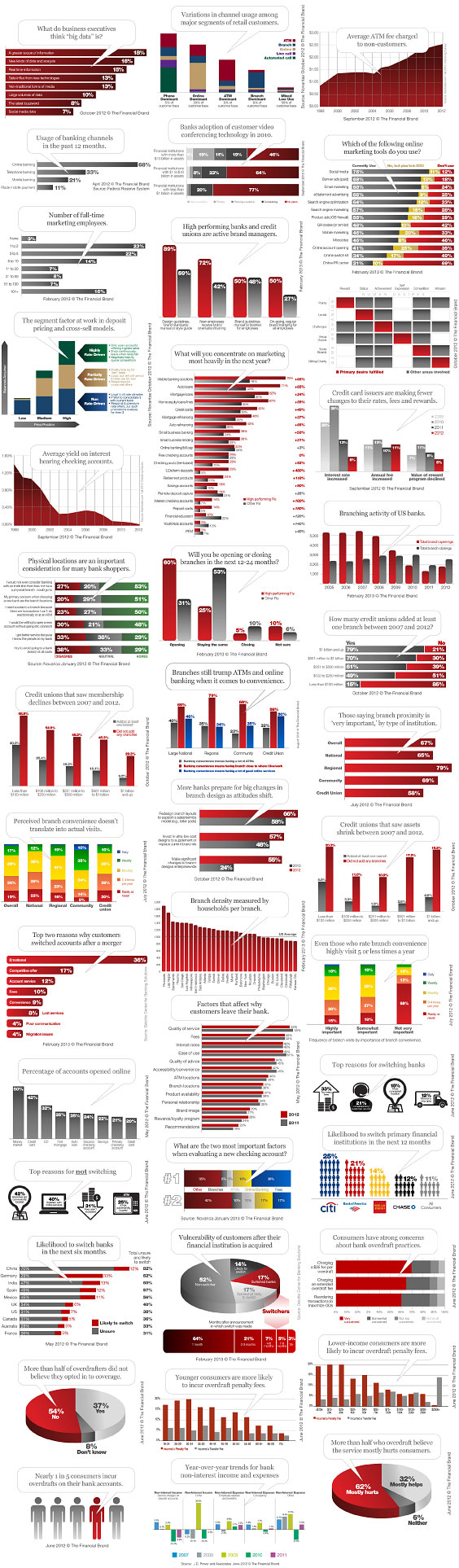

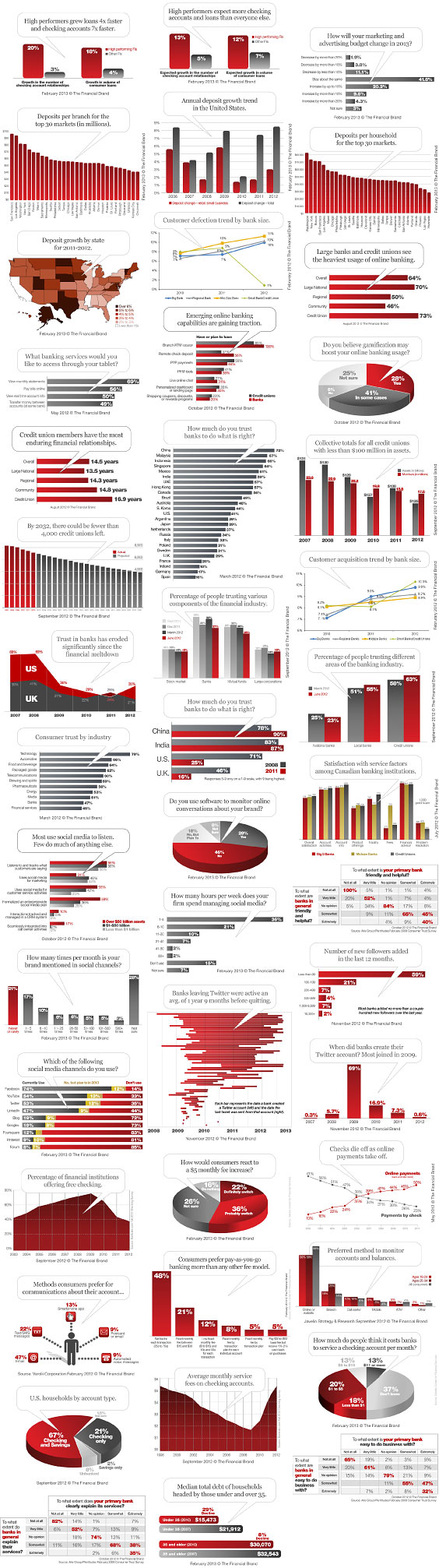

As a business development executive, I continue to partner with banks and FinTech companies as banks outsource technology based products. Due diligence is an important step of the vendor introduction process. Common questions include: Who are your clients? What is your revenue over for the last three years? Who are the individuals on the management team? However, the questions will change as things continue to evolve.

I recall participating in meeting a few years back with a global bank. My client was a software company with great technology, though still in the startup phase. I felt the discussion was doomed from the start, but during the meeting, one of the senior executives told me the bank now has a strong appetite to work with startups. Although initially shocked, I soon began to expand my bank contact network.

Kommentare

Kommentar veröffentlichen